Difference between revisions of "How Did Trade Tariffs Develop"

(→Modern Tariffs) |

m (Admin moved page How Did Trade Tariffs Develop? to How Did Trade Tariffs Develop) |

||

| (26 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

| + | __NOTOC__ | ||

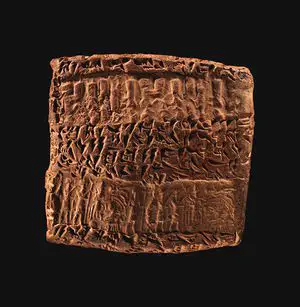

| + | [[File:Main-image.jpeg|thumb|left|300px|Figure 1. Old Assyrian trade colony tablets detail levies paid by merchants. Despite the taxes, the trade proved highly profitable for the merchants. ]] | ||

Trade tariffs have long been part of trading relationships since antiquity. Governments have long taxed products coming through their territories as ways to raise funds either directly for the ruler or the wider government. This is no different today. However, the nature and how tariffs have been applied has changed. | Trade tariffs have long been part of trading relationships since antiquity. Governments have long taxed products coming through their territories as ways to raise funds either directly for the ruler or the wider government. This is no different today. However, the nature and how tariffs have been applied has changed. | ||

| − | ==Early History of Tariffs== | + | ====Early History of Tariffs==== |

| + | Some of the earliest tariffs are recorded from texts in the 3rd and 2nd millennium BCE. The Old Assyrian trade colony in Anatolia, in the ancient city of Kanesh, was a thriving city that received tin metals and wool and traded precious metals to ancient Assyria in modern day northern Iraq. The trade was taxed by local rulers in Anatolia and along the route of trade in Syria. Transit costs and Assyrian merchants living in Kanesh would have to pay taxes in conducting their trade enterprise that appears to be mutually beneficial. | ||

| − | + | Despite the tariffs, traders would make large profits, often doubling their investment with a caravan of goods sent between Assyria and Kanesh. The trade thrived for centuries. Similar to today, merchants wanted to avoid paying tariffs, which sometimes meant taking different routes to conducting trade, but inevitably tariffs were considered part of the cost of business and were priced in the commodities traded (Figure 1).<ref>For more on the Old Assyrian trade colony, see: Barjamovic, Gojko. 2011. <i>A Historical Geography of Anatolia in the Old Assyrian Colony Period</i>. CNI Publications 38. Copenhagen: Carsten Niebuhr Institute of Near Eastern Studies, University of Copenhagen : Museum Tusculanum Press. </ref> | |

| − | The Roman Empire had a series of tariffs in different parts of the empire, although generally there was no unified system. There were internal tariffs, which governed goods that moved within the empire. These goods were taxed at rates ranging between 1-5 percent. Foreign goods could be taxed at rates ranging between 12-25 percent. This often made luxury goods well beyond the means of average Romans. Silk from China, for instance, was in high demand but could mostly only be afforded by the upper elites. | + | The Roman Empire had a series of tariffs in different parts of the empire, although generally there was no unified system. There were internal tariffs, which governed goods that moved within the empire. These goods were taxed at rates ranging between 1-5 percent. Foreign goods could be taxed at rates ranging between 12-25 percent. This often made luxury goods well beyond the means of average Romans. Goods from the East were particularly taxed at high rates. Silk from China, for instance, was in high demand but could mostly only be afforded by the upper elites.<ref>For more on Roman Empire trade, tariffs, and taxes, see: Temin, Peter. 2017. <i>The Roman Market Economy. The Princeton Economic History of the Western World</i>. Princeton, NJ: Princeton Univ. Press. </ref> |

| − | In the Medieval period, around the 13th century, we begin to see more regulation of tariff costs for specific commodities. Wool, for instance, was heavily regulated in England in the 13th and 14th centuries. Other commodities, such as skins and leather, lead, tin, butter, cheese, lard and grease, were levied as well. However, rather than a specified rate, often the taxes were based on the container of the commodity of trade. For instance, a sack of wool was levied at roughly 6 shillings and 8 pence. This could allow merchants, of course, to cheat more easily by switching commodities in sacks, which were taxed at variable rates, or containers were smuggled without a tax | + | In the Medieval period, around the 13th century, we begin to see more regulation of tariff costs for specific commodities. Wool, for instance, was heavily regulated in England in the 13th and 14th centuries. Tariffs were relatively high as wool was seen as an important pillar of the English Medieval economy and protecting it was a chief goal. Other commodities, such as skins and leather, lead, tin, butter, cheese, lard and grease, were levied as well. However, rather than a specified rate, often the taxes were based on the container of the commodity of trade. For instance, a sack of wool was levied at roughly 6 shillings and 8 pence. This could allow merchants, of course, to cheat more easily by switching commodities in sacks, which were taxed at variable rates, or containers were smuggled without a tax. |

| − | + | Items would be weighed but the volume of trade meant not everything could be easily inspected. Ports and trade routes were often levied to directly benefit the crown. This tradition in England, nevertheless, began to influence the rise and development of the modern concept of tariffs that occurred as Britain expanded into an empire in the 17th and 18th centuries.<ref>For more on Medieval trade in England and its tariffs, see: Rose, Susan. 2018. <i>The Wealth of England: The Medieval Wool Trade and Its Political Importance 1100-1600</i>. Oxford: Oxbow Books.</ref> | |

| − | The the late 18th century, Great Britain began to dominate oceanic trade with its powerful navy. At this time, tariffs were very high, roughly 50 percent, which made the import of goods mostly uneconomical. This reflected the political era, where Britain competed with France and Spain for dominance of the high seas, where each actor attempted to limit trade with the other. Tariffs in the early 19th century were | + | ====Modern Tariffs==== |

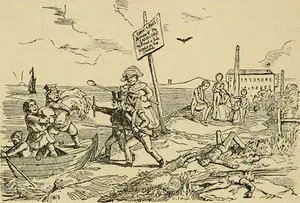

| + | [[File:File-20170720-24017-1hxq3ej.jpg|thumb|left|300px|Figure 2. The Corn Laws were tariffs on agricultural grains that intended to expand the domestic production of food. However, the tariffs impeded aid to Ireland, leading to their eventual removal.]] | ||

| + | In the late 18th century, Great Britain began to dominate oceanic trade with its powerful navy. At this time, tariffs were very high, roughly 50 percent, which made the import of goods mostly uneconomical. This reflected the political era, where Britain competed with France and Spain for dominance of the high seas, where each actor attempted to limit trade with the other. Tariffs in the early 19th century were still high; however, Britain's trade in given products began to greatly expand during the early Industrial Revolution, slowly influencing its outlook on trade. | ||

| − | + | Gradually, Britain reduced tariffs and entirely removed them for food commodities in 1840s with the repeal of the Corn Laws (Figure 2). This was, in part, motivated by events in Ireland, which was experiencing the Great Famine that led to a need to export food. Tariffs were often seen as a way to protect domestic industry and economic sectors such as agriculture. | |

| + | <dh-ad/> | ||

| + | Gradually, throughout the 19th century, as industrial production increased, reducing tariffs was seen as a way to benefit economies looking towards exports of manufactured goods as a mean to growth economies through trade. This followed a general trend throughout Europe, as the economies became more integrated and greater trade now began to flow, resulting in reduced tariffs in Europe. Rather than reduce competition, increased trade spurred countries to emulate each other. Germany in particular began to greatly expand its industries as it rapidly developed its economy and began to be more competitive in trade.<ref>For more on 19th century tariffs and changing attitudes towards them throughout the 19th century in Europe and Britain, see: Howe, Anthony. 1997. <i>Free Trade and Liberal England, 1846-1946</i>. Oxford : New York: Clarendon Press ; Oxford University Press. </ref> | ||

| − | + | In the late 18th century United States, tariffs were seen as a way for the federal government to generate revenue, as income and other forms of federal taxes had yet to be established. By the early 20th century, political parties were beginning to take sides in the debates about tariffs. The Tariff of 1789 was one of the first policies enacted that stipulated the rates and types of tariffs in the United States. Throughout much of the early 19th century, the United States generally kept low tariffs. The South of the United States, in particular, supported very low tariffs. When the federal government attempted to raise tariffs in 1828, the state of South Carolina threatened full rebellion against the federal government. Economic exports of cotton in particular would have been threatened by higher tariffs. | |

| + | After the 1850s, however, with economic hardship that also occurred after the Civil War, gradually most of the country supported high tariffs on goods. This trend continued through the two World Wars. The United States was largely seen as a protectionist economy that made it difficult for foreign countries to penetrate the US market. During the early 19th century, the Whigs supported high tariffs, whereas it was the Democrats who supported low tariffs. From the late 19th century, Europe and the United States were became almost complete separate economies that had little interaction. Tariffs in the United States ranged between 40-50 percent, while it was 9-12 percent in Europe. | ||

| − | + | After the 1930s Great Depression, most countries expanded tariffs and global trade was severely limited as countries tried to protect their domestic industries that were struggling from economic slow-down. Economists still debate if tariffs exacerbated the Great Depression. The Smoot–Hawley Tariff Act of 1930 exemplified protectionist attitudes, with over 10,000 items listed in tariffs. This did cause retaliatory measures by different countries, including Canada, which shifted much a lot of its trade to the British Empire in large part due to the tariff.<ref>For more on the early history of US tariffs, see: Taussig, F. W. 2005. <i>The Tariff History of the United States</i>. Chestnut Hill, Mass.: Elibron Classics. </ref> | |

| − | ==References== | + | ====Recent Developments==== |

| + | Events after World War II have shaped recent economic approaches to tariffs. The General Agreement on Tariffs and Trade (GATT) in 1947 was created with 23 countries in order to help foster multilateral trade that would help the global economy recover after World War II. The GATT became the foundation in which the World Trade Organization (WTO) was built, as it became its successor. The intent of this new economic order was also to fight Communism and trade was seen as vital for US policy in order to counter what they saw as threats from the Soviet Union in attracting countries to their sphere. | ||

| + | |||

| + | GATT became the framework in which other trade agreements, including the European Community (EC), developed into the European Union, in creating regional and bilateral trade agreements. With the fall of Communism in the early 1990s, and the increasing influence of the International Monetary Fund, WTO, and World Bank, countries have increasingly lowered tariffs and signed trade agreements at much higher rates since the 1990s. Regional trade agreements were seen as an important goal, with North America, Europe, Asia, Africa, and South America forming varying agreements. The North American Free Trade Agreement (NAFTA) is an iteration of this in the early 1990s. | ||

| + | |||

| + | Today, free trade agreements have generated controversy as many industries see the benefit of moving manufacturing overseas to lower costs and many countries abandon some forms of manufacturing altogether as countries are better able to produce goods at lower costs. Free trade agreements have helped to reorient global trade, with increasingly low margin manufacturing, such as textiles and basic consumer products, moving to develop countries, while high technology manufacturing is still dominated by most developed countries, although this is also now being challenged. | ||

| + | |||

| + | Rising countries such as Brazil, Russia, India, China, and South Africa (the so-called BRICS) have increasingly benefited from free trade agreements. Nevertheless, in more developed countries, there has been a backlash against free trade agreements because it has had the effect of reducing manufacturing production in some economic sectors.<ref>For more on the evolution of the modern globalized economy and its relation to tariffs, see: Irwin, Douglas A, Petros C Mavroidis, and A. O Sykes. 2009. <i>The Genesis of the GATT</i>. Cambridge; New York: Cambridge University Press. </ref> | ||

| + | |||

| + | ====Summary==== | ||

| + | Tariffs have long been seen as part of the normal operation of business. For most of history, tariffs were high, often leading to global trade involving a relatively small percentage of goods. In the 19th century, tariffs were slowly reduced in Europe and North America, but from the late 19th century the US had some of the highest tariffs among the major powers. This trend continued until after World War II. Since that time, low tariffs across the globalized economy have been seen as a key way to foster a more integrated economic system and one that could promote peace through closer trade cooperation. | ||

| + | |||

| + | However, there has been a lot of controversy around this, as increasingly globalized trade is seen as producing environmental harm, weakening manufacturing in some countries, and some see it as having forced some countries to conform to a single global economic order that not all agree with. | ||

| + | |||

| + | <div class="portal" style='float:left; width:35%'> | ||

| + | ====Related Articles==== | ||

| + | {{#dpl:category=Economic History|ordermethod=firstedit|order=descending|count=9}} | ||

| + | </div> | ||

| + | |||

| + | [[Category:Wikis]] [[Category:Economic History]] [[Category:United States History]] [[Category: European History]] | ||

| + | |||

| + | ====References==== | ||

| + | <references/> | ||

Latest revision as of 02:25, 23 September 2021

Trade tariffs have long been part of trading relationships since antiquity. Governments have long taxed products coming through their territories as ways to raise funds either directly for the ruler or the wider government. This is no different today. However, the nature and how tariffs have been applied has changed.

Early History of Tariffs

Some of the earliest tariffs are recorded from texts in the 3rd and 2nd millennium BCE. The Old Assyrian trade colony in Anatolia, in the ancient city of Kanesh, was a thriving city that received tin metals and wool and traded precious metals to ancient Assyria in modern day northern Iraq. The trade was taxed by local rulers in Anatolia and along the route of trade in Syria. Transit costs and Assyrian merchants living in Kanesh would have to pay taxes in conducting their trade enterprise that appears to be mutually beneficial.

Despite the tariffs, traders would make large profits, often doubling their investment with a caravan of goods sent between Assyria and Kanesh. The trade thrived for centuries. Similar to today, merchants wanted to avoid paying tariffs, which sometimes meant taking different routes to conducting trade, but inevitably tariffs were considered part of the cost of business and were priced in the commodities traded (Figure 1).[1]

The Roman Empire had a series of tariffs in different parts of the empire, although generally there was no unified system. There were internal tariffs, which governed goods that moved within the empire. These goods were taxed at rates ranging between 1-5 percent. Foreign goods could be taxed at rates ranging between 12-25 percent. This often made luxury goods well beyond the means of average Romans. Goods from the East were particularly taxed at high rates. Silk from China, for instance, was in high demand but could mostly only be afforded by the upper elites.[2]

In the Medieval period, around the 13th century, we begin to see more regulation of tariff costs for specific commodities. Wool, for instance, was heavily regulated in England in the 13th and 14th centuries. Tariffs were relatively high as wool was seen as an important pillar of the English Medieval economy and protecting it was a chief goal. Other commodities, such as skins and leather, lead, tin, butter, cheese, lard and grease, were levied as well. However, rather than a specified rate, often the taxes were based on the container of the commodity of trade. For instance, a sack of wool was levied at roughly 6 shillings and 8 pence. This could allow merchants, of course, to cheat more easily by switching commodities in sacks, which were taxed at variable rates, or containers were smuggled without a tax.

Items would be weighed but the volume of trade meant not everything could be easily inspected. Ports and trade routes were often levied to directly benefit the crown. This tradition in England, nevertheless, began to influence the rise and development of the modern concept of tariffs that occurred as Britain expanded into an empire in the 17th and 18th centuries.[3]

Modern Tariffs

In the late 18th century, Great Britain began to dominate oceanic trade with its powerful navy. At this time, tariffs were very high, roughly 50 percent, which made the import of goods mostly uneconomical. This reflected the political era, where Britain competed with France and Spain for dominance of the high seas, where each actor attempted to limit trade with the other. Tariffs in the early 19th century were still high; however, Britain's trade in given products began to greatly expand during the early Industrial Revolution, slowly influencing its outlook on trade.

Gradually, Britain reduced tariffs and entirely removed them for food commodities in 1840s with the repeal of the Corn Laws (Figure 2). This was, in part, motivated by events in Ireland, which was experiencing the Great Famine that led to a need to export food. Tariffs were often seen as a way to protect domestic industry and economic sectors such as agriculture.

Gradually, throughout the 19th century, as industrial production increased, reducing tariffs was seen as a way to benefit economies looking towards exports of manufactured goods as a mean to growth economies through trade. This followed a general trend throughout Europe, as the economies became more integrated and greater trade now began to flow, resulting in reduced tariffs in Europe. Rather than reduce competition, increased trade spurred countries to emulate each other. Germany in particular began to greatly expand its industries as it rapidly developed its economy and began to be more competitive in trade.[4]

In the late 18th century United States, tariffs were seen as a way for the federal government to generate revenue, as income and other forms of federal taxes had yet to be established. By the early 20th century, political parties were beginning to take sides in the debates about tariffs. The Tariff of 1789 was one of the first policies enacted that stipulated the rates and types of tariffs in the United States. Throughout much of the early 19th century, the United States generally kept low tariffs. The South of the United States, in particular, supported very low tariffs. When the federal government attempted to raise tariffs in 1828, the state of South Carolina threatened full rebellion against the federal government. Economic exports of cotton in particular would have been threatened by higher tariffs.

After the 1850s, however, with economic hardship that also occurred after the Civil War, gradually most of the country supported high tariffs on goods. This trend continued through the two World Wars. The United States was largely seen as a protectionist economy that made it difficult for foreign countries to penetrate the US market. During the early 19th century, the Whigs supported high tariffs, whereas it was the Democrats who supported low tariffs. From the late 19th century, Europe and the United States were became almost complete separate economies that had little interaction. Tariffs in the United States ranged between 40-50 percent, while it was 9-12 percent in Europe.

After the 1930s Great Depression, most countries expanded tariffs and global trade was severely limited as countries tried to protect their domestic industries that were struggling from economic slow-down. Economists still debate if tariffs exacerbated the Great Depression. The Smoot–Hawley Tariff Act of 1930 exemplified protectionist attitudes, with over 10,000 items listed in tariffs. This did cause retaliatory measures by different countries, including Canada, which shifted much a lot of its trade to the British Empire in large part due to the tariff.[5]

Recent Developments

Events after World War II have shaped recent economic approaches to tariffs. The General Agreement on Tariffs and Trade (GATT) in 1947 was created with 23 countries in order to help foster multilateral trade that would help the global economy recover after World War II. The GATT became the foundation in which the World Trade Organization (WTO) was built, as it became its successor. The intent of this new economic order was also to fight Communism and trade was seen as vital for US policy in order to counter what they saw as threats from the Soviet Union in attracting countries to their sphere.

GATT became the framework in which other trade agreements, including the European Community (EC), developed into the European Union, in creating regional and bilateral trade agreements. With the fall of Communism in the early 1990s, and the increasing influence of the International Monetary Fund, WTO, and World Bank, countries have increasingly lowered tariffs and signed trade agreements at much higher rates since the 1990s. Regional trade agreements were seen as an important goal, with North America, Europe, Asia, Africa, and South America forming varying agreements. The North American Free Trade Agreement (NAFTA) is an iteration of this in the early 1990s.

Today, free trade agreements have generated controversy as many industries see the benefit of moving manufacturing overseas to lower costs and many countries abandon some forms of manufacturing altogether as countries are better able to produce goods at lower costs. Free trade agreements have helped to reorient global trade, with increasingly low margin manufacturing, such as textiles and basic consumer products, moving to develop countries, while high technology manufacturing is still dominated by most developed countries, although this is also now being challenged.

Rising countries such as Brazil, Russia, India, China, and South Africa (the so-called BRICS) have increasingly benefited from free trade agreements. Nevertheless, in more developed countries, there has been a backlash against free trade agreements because it has had the effect of reducing manufacturing production in some economic sectors.[6]

Summary

Tariffs have long been seen as part of the normal operation of business. For most of history, tariffs were high, often leading to global trade involving a relatively small percentage of goods. In the 19th century, tariffs were slowly reduced in Europe and North America, but from the late 19th century the US had some of the highest tariffs among the major powers. This trend continued until after World War II. Since that time, low tariffs across the globalized economy have been seen as a key way to foster a more integrated economic system and one that could promote peace through closer trade cooperation.

However, there has been a lot of controversy around this, as increasingly globalized trade is seen as producing environmental harm, weakening manufacturing in some countries, and some see it as having forced some countries to conform to a single global economic order that not all agree with.

Related Articles

- What is the History of Public Debt

- American Slavery, American Freedom - Book Review

- How Did Stock Markets Develop

- How Did Modern Monetary Theory Develop

- Why Did the Bretton Woods Economic System End

- How Did the Athenians Fund Their Military during the Peloponnesian War?

- Popular Culture in the Age of White Flight - Book Review

- A Consumers’ Republic - Book Review

References

- ↑ For more on the Old Assyrian trade colony, see: Barjamovic, Gojko. 2011. A Historical Geography of Anatolia in the Old Assyrian Colony Period. CNI Publications 38. Copenhagen: Carsten Niebuhr Institute of Near Eastern Studies, University of Copenhagen : Museum Tusculanum Press.

- ↑ For more on Roman Empire trade, tariffs, and taxes, see: Temin, Peter. 2017. The Roman Market Economy. The Princeton Economic History of the Western World. Princeton, NJ: Princeton Univ. Press.

- ↑ For more on Medieval trade in England and its tariffs, see: Rose, Susan. 2018. The Wealth of England: The Medieval Wool Trade and Its Political Importance 1100-1600. Oxford: Oxbow Books.

- ↑ For more on 19th century tariffs and changing attitudes towards them throughout the 19th century in Europe and Britain, see: Howe, Anthony. 1997. Free Trade and Liberal England, 1846-1946. Oxford : New York: Clarendon Press ; Oxford University Press.

- ↑ For more on the early history of US tariffs, see: Taussig, F. W. 2005. The Tariff History of the United States. Chestnut Hill, Mass.: Elibron Classics.

- ↑ For more on the evolution of the modern globalized economy and its relation to tariffs, see: Irwin, Douglas A, Petros C Mavroidis, and A. O Sykes. 2009. The Genesis of the GATT. Cambridge; New York: Cambridge University Press.