Why Did the Bretton Woods Economic System End

The Bretton Woods economic system or monetary regime was a short-lived economic system, but it played a vital role in the formation of the post-World War II order and continues to affect geo-politics and economics in many ways. The system lasted from 1945 until 1973 and is thought of by many economists and historians as the primary reason for the peace and prosperity of the mid-twentieth century. Under the Bretton Woods economic system, the world experienced generally low unemployment, no major economic collapses, inflation that was controllable, smaller national imbalances, and much less of a wealth gap. The Bretton Woods system was also responsible for the creation of the International Monetary Fund (IMF) and the World Bank and paved the way for a new era of globalization that was led by the American dollar.

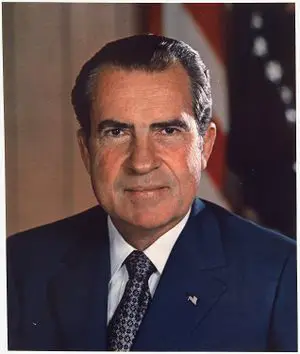

Although this system is viewed by many as the emblem of a halcyon period, it was not without its problems and it eventually failed, rather quickly. A combination of problems inherent in the system and international rivalries, which the system was in part supposed to end, led to Bretton Woods’ undoing. The fact that the system was still nominally tied to gold created problems with liquidity, while the American dollar being the standard currency led many members to distrust the supposed equity of the system. Eventually, member nations began ignoring the rules and devalued their currencies at will, while others, such as France, attempted to convert all of their dollars into gold. Finally, in 1973 American President Richard Nixon took the United States out of the system and into the current economic era.

The Creation of the Bretton Woods System

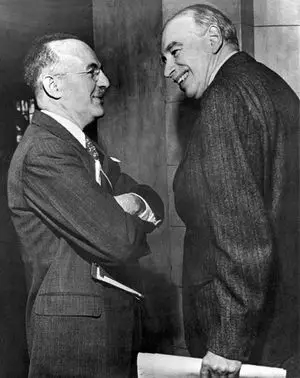

The Bretton Woods system was the result of the brainstorming of two of the most influential economists of the twentieth century, Englishman John Maynard Keynes (1883-1946) and American Harry Dexter White (1882-1948). Keynes was the better known of the two and the most academically accomplished. He worked for the British government off and on throughout his life as well as lecturing at universities. A well published scholar, Keynes is best known for his 1936 book, The General Theory of Employment, Interest, and Money. Simply put, Keynes believed that governments had a responsibility to occasionally play an active role in the economy of a country by enacting programs to increase consumption and to reduce unemployment. [1] The idea that the government should intercede to keep unemployment low in a capitalist country was derided by some as communism, but many world leaders and economists liked the idea and in later years began referring to the theory generally as “Keynesian.”

Harry White was less well-known than Keynes generally speaking, but still highly regarded among economists in the West. He was a short and assuming man, but with plenty of energy and ideas about how the post-World War II economy should function. Interestingly, it was later determined that White worked with the Soviet Union, although how deeply he was involved has never been determined. [2]

After several months of negotiating, which was hampered by the still undecided wars in Europe and the Pacific, the leaders of the Allied nations agreed to send representatives to a sleepy, unincorporated community known as Bretton Woods in the White Mountains of New Hampshire. The conference was held from July 1 to 22, 1944 in the historic Mount Washington Hotel. Although American elites such as the Vanderbilts and Rockefellers visited the hotel in its heyday, by the 1940s it was a shadow of its once great past. The organizers, though, chose the hotel due to its large size and its location: it was easy to control all access points in order to protect the important guests and its high elevation and northern latitude mitigated the effects of an especially hot and humid summer. Officially, the Bretton Woods Conference was known as the “United Nations Monetary and Financial Conference,” but despite its importance only partial transcripts of the proceedings exist. [3]

The End of the Gold Standard

When the Bretton Woods Conference was conducted, the world was at war and had been without a standard monetary regime for a number of years. The Classical Gold Standard had gradually ended after World War I with an influx of the world’s gold filling the chambers of Fort Knox. Although there were some moves to revamp the Gold Standard after the war, the Great Depression made sure that countries would go their own ways. European nations began devaluing their currencies in 1931 in order to increase exports and their currency supplies with little to no effect. American President Franklin Roosevelt responded with his own measures, which included the New Deal, but also an executive order that confiscated privately held gold. The government paid the private holders well below the market valuation for their gold, effectively ending the Gold Standard. [4] Keynes, White, and most of the other prominent economists of the time knew that the world would not return to the unwieldly Gold Standard anytime soon, so replacing it became the subject of many debates and academic publications. As the debates raged in the West, Keynes found an unlikely source of inspiration in National Socialist Germany.

In 1940, Walther Funk, the German economic minister, issued a bold new economic plan for Europe. Funk’s plan called for all currencies of the new Nazi economic bloc to be pegged to the German Reichsmark as the standard currency. All international payments would be conducted through a central office in Berlin and although gold would still have a value, currency would no longer be tied to it. Keynes was impressed with several aspects of the Funk plan and used some of it to outline his initial ideas at the Bretton Woods Conference. [5] White was also familiar with the Funk plan and was willing to allow Keynes great leeway during the conference, but in the end did whatever he could to make sure that the United States was the nation calling the shots.

How the System Worked

Although Keynes and White had many disagreements pertaining to the details of the new economic system, they both agreed what the system would not be – another Gold Standard. Because the United States had the largest gold reserve at the time, White argued that gold should still play a role in the new system. Keynes was not totally on board with the idea at first, but both men agreed that exchange rates should be fixed to some type of currency, which would probably be backed or valued according to gold. [6] The men primarily sought to create a system that stabilized and corrected international currency imbalances to avoid what happened during the Great Depression. Such a system would, they believed, limit the speculation of currency and mitigate or eliminate the chance of a currency war. [7] The problem, though, was creating a plan that the United States Congress would accept.

Since Congress would only accept a plan where gold played an important role, the Bretton Woods System had to be written in a way that made it look like a modified gold standard. The final result of the Bretton Woods Conference created a system that did indeed have some elements of the Classical Gold Standard, but was certainly a twentieth century idea. The U.S. dollar became the currency all other currencies were anchored to and dollars were convertible into gold by trading partners at $35 an ounce. Unlike the Classical Gold Standard, though, individuals could not redeem dollars for gold at local banks. The IMF would provide loans on a short term to countries experiencing deficits. In order to create even more global economic security, countries could only devalue their currencies with IMF permission and reasonable notice was required. [8] The final result was that the Bretton Woods system was essentially a modified gold standard where the international flow of capital was more tightly regulated. The plan passed overwhelmingly by Congress and became law in the United States in July 1945. [9]

The End of the Bretton Woods System

As well planned and thought out as the Bretton Woods system may have been, it also came with many inherent problems that led to its eventual demise. The primary problem was also a bit of a paradox that Keynes apparently never considered. As the Bretton Woods system grew, it required a growing “gold pool” to keep pace with the ever increasing currency. By 1960, the amount of dollars circulating throughout the world far exceeded the value of the gold pool in Fort Knox. [10] Part of the problem was due to increased American spending on the Vietnam War and President Johnson’s Great Society program, but issues outside of the Americans’ control also began to take a toll on the system.

France was also a major player in the Bretton Woods system, but never content to be fourth or fifth in the pecking order. In 1966, France left NATO and two years later it converted $150 million of its reserve dollars into gold and then left the gold pool, essentially ending their involvement in the Bretton Woods System. [11] France’s departure certainly hurt and signaled the possible first shot in a new currency war. Speculative attacks on the dollar began taking place, further eroding confidence in the system and America’s leadership. [12] But many economists and historians believe the system still could have been saved if appropriate changes had been made.

As farsighted as the Bretton Woods plan was in many ways, it failed to add mechanisms that could have corrected or at least mitigated some problems. There were also no mechanisms in place to maintain the favorable circumstances or “good times” of the mid-1950s to late 1960s. Some economists point out that some exchange rate flexibility may have saved the system or at least stopped its quick collapse. [13]

President Nixon Takes a Stand

On the evening of Sunday, August 15, 1971, millions of Americans got ready to watch the latest episode of Bonanza, but were instead greeted with a preempted speech by President Nixon about the current economic situation. Nixon announced that to combat the impending currency war and global economic instability, he was imposing wage and price controls and a 10% surtax on imports, and that the “gold window” would be closed. [14] The Group of 10 (G10) then met in December of that year at the Smithsonian Institute in Washington, D.C. to hammer out a new economic agreement. The dollar was devalued by about 9% against gold and other major currencies were revalued upward between 3% and 8% against the dollar for a total adjustment between 11% and 17%. The agreement was supposed to stop a trade and/or currency war and possibly save what was left of Bretton Woods, but it led to about ten years of higher than average unemployment, inflation, and a collapsed GDP. The IMF finally declared the Bretton Woods system dead in 1973, moving the world’s economic system to one of floating, unpegged currencies. [15]

Conclusion

The Bretton Woods System proved to be an extremely successful vehicle that brought economic stability to the world after the chaos of World War II. For a short time, the world witnessed incredible economic growth, low unemployment, and a much lower wealth gap due to the this system. But the Bretton Woods system collapsed overnight due to a number of factors. The reliance on gold allowed some members to manipulate the system, while others simply did not follow some of the rules, especially regard the devaluation of currencies. There was also a lack of foresight regarding how to fix problems that eventually did arise. In the decades since the collapse of the Bretton Woods System there have been calls to bring it back, or at least some version of it, but it seems more likely that it will remain forever a thing of the past as a teaching tool for economists and historians.

Related Articles

- What is the History of Public Debt

- American Slavery, American Freedom - Book Review

- How Did Stock Markets Develop

- How Did Modern Monetary Theory Develop

- How Did Trade Tariffs Develop

=References

- ↑ Best, Jacqueline. “Hollowing out Keynesian Norms: How the Search for a Technical Fix Undermined the Bretton Woods Regime.” Review of International Studies 30 (2004) p. 388

- ↑ Conway, Ed. The Summit: Bretton Woods, 1944: J.M. Keynes and the Reshaping of the Global Economy. (London: Pegasus Books, 2014), pgs. 152-64

- ↑ Conway, pgs. 5-10

- ↑ Conway, p. 82

- ↑ Conway, pgs. 99-102

- ↑ Conway, p. 124

- ↑ Best, p. 389

- ↑ Rickards, James. Currency Wars: The Making of the Next Global Crisis. (New York: Portfolio/Penguin, 2012), pgs. 78-79

- ↑ Conway, p. 301

- ↑ Conway, p. 375

- ↑ Rickards, pgs. 82-84

- ↑ Best, p. 396

- ↑ Williamson, John. “On the System in Bretton Woods.” American Economic Review 75 (1985) p. 78

- ↑ Rickards, p. 86

- ↑ Rickards, pgs. 91-92