When did taxation emerge

There is a saying that the only two certainties in life are death and taxes. While this may make taxation sound like a strongly embedded idea in society, the historical development of taxes did begin with the rise of early states. However, taxes have been redefined and have conceptually evolved over the centuries, while they still retain their primary goal of funding government interests.

Early History

With the development of complex institutions, in particular governments ruled by kings, taxes became one of the ways such institutions thrived. While we often think of taxes as a set percentage per year that we pay, this might not have been the case in early examples of taxes. One of the earliest form of taxes was corvée, where labor by individuals for a period of time was given to the authorities to construct canals and other infrastructure. This was the case in both Mesopotamia (southern Iraq) and Egypt, where such labor would be required for periods of time from different families living with the state or even towns.[1]

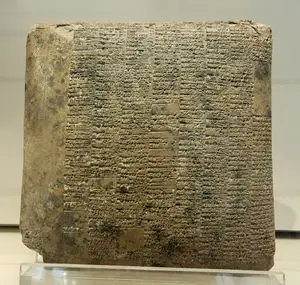

Early records from Mesopotamia, from the early 3rd millennium BCE, also indicate forms of tithes or percentages of obligation that was required from individuals. This could have been traders or normal individuals who owned revenue to institutions, such as temples, and the state. Taxes, over time, also became more regular and expected flows towards the state. In fact, many scholars see that taxation may have been one of the primary motives for writing to more fully develop by this time in southern Mesopotamia, where written language indicate more sophisticated writing systems by 2900-2500 BCE, with this system developing further into the 2nd millennium BCE (Figure 1).[2]

In Egypt, the system may have been even more centralized, where often Pharaoh and the priestly classes held a lot of power. In this case, people and revenue could be conscripted or taxed on regular schedules. The Egyptians justified this by claiming everything belonged to Pharaoh anyway and the percentages sent to the central government in Memphis represented a percentage from the different nomes, or small provinces within Egypt. These obligations helped fuel the major building activity in the Early Dynastic period such as the Great Pyramids in Giza, which helped to reinforce Pharaoh's central authority and thus the tax-based system created.[3]

Mesopotamia in the late 3rd millennium BCE, by about 2100 BCE, created another form of taxation, called Bala, that revolved responsibility to different cities and also required different types and amounts of revenue depending on how linked the city was to the central government. Some cities that specialized in agricultural products would be required to send those products to the central government, while others specializing in wood or other natural products could send those as part of their tax obligations. These items were collected and deposited in central facilities that acted as a collection point. The system then created a large bureaucratic structure that had many dependents who relied upon taxation from the controlled cities. The state itself would use these resources in redistributing goods to enable building projects or use the goods directly for projects or payments.[4]

Rise of Taxes

The two developments of empires and currency by the mid-1st millennium BCE led to complex tax systems that began to resemble our own systems today. The Achaemenid Empire created a regulated system that was based on earlier systems, such as the Assyrian Empire, but the system began to change as currency began to be more utilised in the Greek-speaking parts of the Empire and the Greek world itself. Provinces now had specific obligations and those obligations had to be met through silver. There were attempts then to standardize revenue collected by the state into a type of currency (e.g., silver) rather than as a variety of products. This also meant that the state now had to understand the land it controlled in more detail, as the types of crops, fruit trees, and other forms of revenue generation had to be identified so that an estimate on tax obligations could be calculated (and thus a budget determined by the state).[5]

The development of coinage allowed the state to obtain funds in new ways. It now created a system where people had to exchange goods or their own currency to obtain local coins. The state now could create favorable exchange rates as a form of revenue generation. Coins, in effect, allowed taxes to be hidden and allowed the authority of the state to be made clear. This caught on in the Aegean and Anatolian cities at first but later began to spread throughout the Mediterranean and Middle East. It became clear that currency did not have to be a direct transfer of value on a one to one basis but rather currency could have value potentially above the value of the metal itself, allowing for greater revenue generation by the state as it taxed foreigners coming into the state and citizens as well.[6]

The Roman Empire created a series of specialized taxes that saw it tax things such as trade, military obligations, inheritance, sales, religious activities, slave trade, land, as well as other revenue. In effect, the Roman Empire depended on a series of specialized taxes and obligations. While some taxes were obligatory, the state also created a series of tax revenues that could be generated by people using the state's services or performing certain functions (e.g., selling slaves).[7]

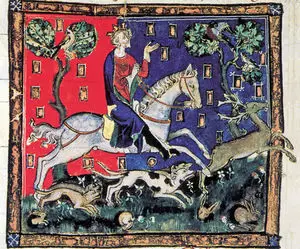

In the Medieval period, various forms of taxes developed that included religious as well as state-based taxes. Land taxes, tithes, feudal taxes, and poll tax were typical taxes developed. Earlier systems, such as in England during the Anglo-Saxon period, did not require compulsory taxation but they, instead, used fines as forms of taxation. Norman England created a universal land tax for all classes. Taxation, however, became a source of contention, leading to a system where the king would have to get consent from leading individuals and nobles from different regions. During the reign of King John in the 12th and early 13th centuries, there were attempts to make taxes a larger supply or portion of the king's overall revenue, where even annual income by individuals was now something taxed by the king (which was rare in earlier periods and until the 19th century). This created conflict with nobles. Over time, through Magna Carta and other agreements, an assembly of nobles and other land owners that gave consent on taxes helped form the bases of Parliament that developed in the 13th century and, eventually, the foundation of modern democratic institutions (Figure 2).[8]

Later Development

Today, in many Western economies, corporate and income taxes, along with sales taxes, form the basis of taxation. Income tax that was levied from individuals on an annual basis was introduced by the United Kingdom in 1799. This new form of income tax also became established as a progressive tax, where rates of taxation were based on income and overall revenue generated. This became a point of controversy throughout the early 19th century but became after that the more accepted form of taxation. By 1842, the taxation system in the UK became more permanent, leading to the system being only revised rather than being repealed and reintroduced as it was in earlier periods. By the 1860s, the British government had become too dependent on progressive tax, making it then a permanent fixture that is now still in use.[9]

In the United States, similarly, the 19th century often saw temporary measures or use of progressive tax. Abraham Lincoln used it to finance the Civil War. It took the 16th Amendment, which gave Congress full power to levy all income taxes to make the system of progressive tax in the United States universal and permanent. Governments in many other countries also saw the benefits of a progressive tax, while the population saw this as a more fair system that would tax wealthier individuals more than less earning individuals.[10]

Summary

Taxation has been a long-lived presence in societies, as states developed by the beginning of the 3rd millennium BCE. However, such forms of taxes varied. Initially, it was simply taking common goods such as agricultural products or even labor and redistributing them to the state. With coinage, a new, more direct way was developed in taxes, while it also became possible to tax in value more than the weight of the precious metal that made up coins. Roman taxes became more diversified in areas where taxes were applied, where many services of the state also became taxed. Modern taxes, affecting income in so-called progressive tax structures, developed as early as 1799 but came into maturity over the 19th and early 20th centuries in the US and UK after periods of great contention.

References

- Jump up ↑ For more on early Mesopotamian and Egyptian taxation, see: Smith, S. (2015) Taxation: a very short introduction. Very short introduction. Oxford, Oxford University Press.

- Jump up ↑ For more on the concept of tithes and percentages of income as a form of religious or government tax, see: Stevens, M.E. (2006) Temples, tithes, and taxes: the temple and the economic life of ancient Israel. Peabody, Mass, Hendrickson Publishers.

- Jump up ↑ For more on Egyptian taxation and the use of the nomes, see: Ruiz, A. (2001) The spirit of ancient Egypt. [Online]. New York, Algora Publishing. [Accessed: 8 September 2017], pg. 68.

- Jump up ↑ For more on the Bala system, see: Justin Cale Johnson & Steven J. Garfinkle (eds.) (2008) The growth of an early state in Mesopotamia: studies in Ur III administration: proceedings of the First and Second Ur III workshops at the 49th and 51st Rencontre assyriologique internationale, London July 10, 2003 and Chicago July 19, 2005. Biblioteca del próximo oriente antiguo 5. Madrid, Consejo Superior de Investigaciones Científicas.

- Jump up ↑ For more on Achaemenid taxation, see: Pirngruber, R. (2017) The economy of Late Achaemenid and Seleucid Babylonia. Cambridge, United Kingdom ; New York, NY, USA, Cambridge University Press, pg. 42.

- Jump up ↑ For more on the role of coinage and tax, see: Schaps, D.M. (2004) The invention of coinage and the monetization of ancient Greece. Ann Arbor, University of Michigan Press.

- Jump up ↑ For more on Roman taxes, see: McGeough, K.M. (2004) The Romans: new perspectives. Understanding ancient civilizations. Santa Barbara, Calif, ABC-CLIO, pg. 114.

- Jump up ↑ For more on early Medieval and English tax systems, see: Frecknall-Hughes, J. (2015) The theory, principles and management of taxation: an introduction. Abingdon, Oxon ; New York, NY, Routledge.

- Jump up ↑ For more on development on modern income taxes, see: Seligman, E.R.A. (2006) The income tax. London, Elibron Classics.

- Jump up ↑ For more on the development of modern governments and taxation, see: Sabine, B.E.V. (2010) A history of income tax: the development of income tax from its beginning in 1799 to the present day related to the social, economic and political history of the period. London; New York, Routledge.

Maltaweel, Admin and EricLambrecht